News & Tips

Victorian Land Market Reaches New Heights Despite Lower Supply

Victoria’s land market finished 2017 the way it started; with eager buyers snapping up blocks faster than developers can bring them to market, putting upward pressure on prices.

Oliver Hume’s new Quarterly Market Report, released today, showed the December quarter saw the volume of sales for the year rise to well over 50% higher than the previous peak in 2008/09 while average prices were up 6% across metropolitan Melbourne.

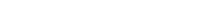

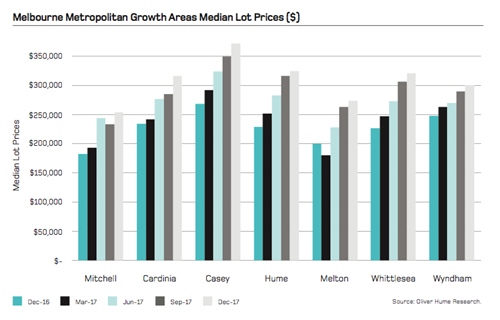

The median price of land in metropolitan Melbourne’s growth areas reached $301,500 in the fourth quarter, up 3.0% (or $8,850 from $292,650 in the September quarter of 2017.)

The research, compiled from analysing thousands of transactions, showed around 5,000 land sales in the three months to the end of December across key markets in Victoria.

Oliver Hume Director Paul Ciprian said the strong December quarter result ensured that median lot prices rose generally by at least a third throughout 2017, and in some cases, by more than 40%.

“Victoria’s improving economy and labour market have been a key driver of the new land market,” Mr Ciprian said. “Following the end of the mining and resources boom and the transition to more broad-based growth Victoria, together with NSW, have created the most number of jobs in Australia.”

The recent run of price growth continued into 2017 with media prices rising between 21% (Wyndham) and 42% (Hume and Whittlesea) from the December quarter in 2016 to the December quarter in 2017.

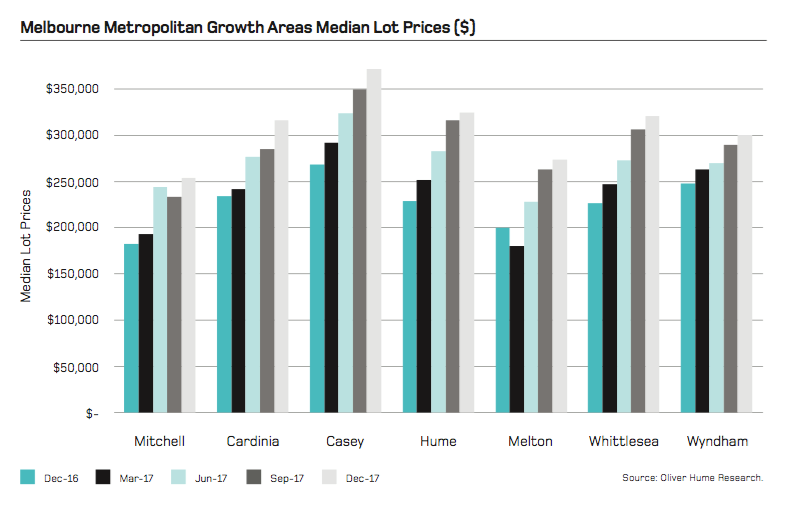

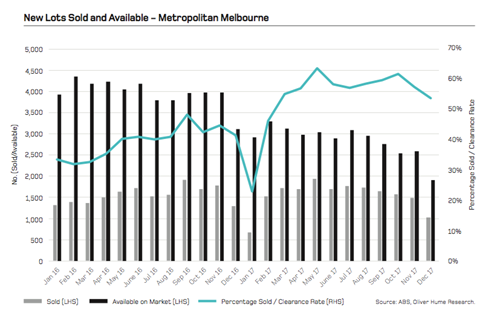

Mr Ciprian said an emerging trend over the last year has been a decline in the stock offered to market (lots available) as developers and vendors sought to adjust to capacity constraints and longer time to title.

“The reduction in available supply has led to clearance rates in the land market rising sharply during the course of 2017, adding somewhat to an improvement in underlying demand conditions and placing upwards pressure on prices.”

The lower level of stock in the December quarter, combined with the traditionally slower Christmas period, was reflected in the total number sales falling 18% from more than 6,000 in the September quarter to 5,070 in the December quarter.

The number of active projects in key Victorian municipalities in the December quarter fell to 170, down 5%, primarily due to sold out projects not being replaced with new projects.

Melbourne’s west remains the city’s major growth corridor with over 50 active projects; the northern corridor had 38 active projects, while the south-east corridor had over 31 projects.

Oliver Hume National Head of Research George Bougias said while price growth in the recent property cycle had been strong, the Melbourne land market remained relatively affordable especially when compared with Sydney.

“Population growth is supported by near record levels of overseas and interstate migration as the state continues to attract new residents,” he said. “These high levels of migration continue to provide the foundations for the ongoing strength of the new land market,” he said.

Victoria’s population growth in the year to June 2017 exceeded 144,000 (up 2.3%) with Victoria now home to more than 6.3 million people

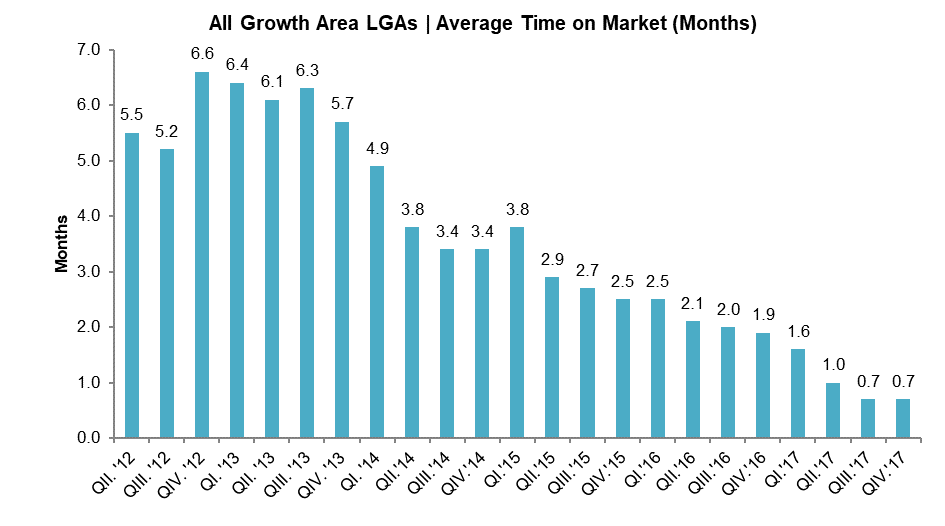

Time On Market

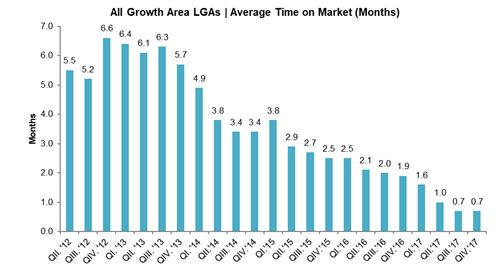

Melbourne land continues to be some of the hottest property in the country, with new lots now lasting only around 21 days before being snapped up by eager buyers, down from nearly 200 days five years ago.

Except for the first quarter of 2015, the average time on market has now fallen or remained steady in every quarter since the third quarter of 2013, after peaking in the current cycle at 6.6 months at the end of 2012.

The statistic measures the period from when a piece of land is released for sale by a developer until it is contracted by a purchaser.

For more information visit www.oliverhume.com.au

ENDS: Media enquiries to Ben Ready on 0415 743 838.