News & Tips

South East Queensland land market set to take flight

South East Queensland’s land market is expected to be one of the major beneficiaries of the Federal election with loosening credit controls and local economic also helping to drive demand over the next 12 months, according to leading Australian property services group Oliver Hume.

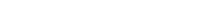

Oliver Hume today released preliminary data from its Quarterly Market Insights (QMI) report for SEQ, showing SEQ median prices continued to edge higher in the March quarter, adding to the gains achieved over the last 12 months.

The median price of lots sold in the Brisbane local government area experienced the strongest growth in the south east corner, increasing from $352,375 to $385,375 (9%) in the year to the end of March. The Gold Coast (up 7% to $341,200), Ipswich (up 3% to $212,975) and also experienced strong growth for the year.

Oliver Hume National Head of Research George Bougias said the strong foundations established over the last 12 months would be the basis for a bumper year ahead with a number of factors which had stymied demand being removed in the space of a week.

“Many people had factored in a change of government and the implementation of a range of policies which were pretty unfriendly to the property industry,” he said. “The return of the Morrison government has removed those risks.”

“Coupled with expectations of a rate cut, APRA’s decision to wind back the serviceability criteria it imposes on banks and a new federally-funded first home buyer incentive we would expect momentum in SEQ to build throughout the rest of the year and into 2020.

“These factors combined with robust population growth and a stable employment market create the perfect recipe for some solid growth in volumes and sales.”

Mr Bougias said the Queensland economy was continuing to improve, buoyed by gas exports, tourism and population growth.

“The improvement is gradually helping to lift the state’s share of national output with the state returning to trend as one of Australia’s faster growing jurisdictions,” he said. “These factors have been the only thing supporting the SEQ market in recent times.”

Oliver Hume Queensland General Manager Matt Barr said the south east Queensland market was similar to most major markets around the country, with increasing demand for smaller lots.

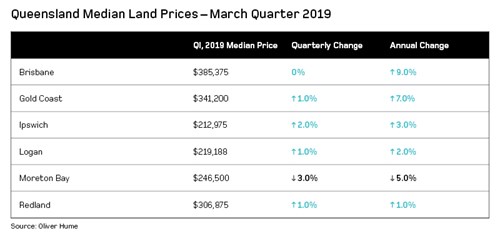

Mr Barr said declining lot sizes meant the median price for any one market does not always reflect the true scope of price changes. To gain a more accurate picture of prices Oliver Hume also tracks the average value rate of land, or the price per square metre for sales.

As at the March quarter the average was value rate of lots sold in the Brisbane local government areas was the highest ($961 per square metre). This was up 0.4% for the quarter and 11% for the year. The Ipswich local government area was the most affordable location with an average value rate basis ($498).

While the Brisbane local government area experienced the greatest increase in average value rates (11%), the Moreton Bay local government area experienced the greatest relative decline in lot sizes (down 8%).

Across South East Queensland 300-400 sqm lots continue to represent the majority of lots sold.

“In recent years an increasing share of smaller lots have been sold. For example over the period from the December quarter 2017 to the March quarter 2019 the share of lots sold sized 601-1000 sqm has decreased from 14% to 9%,” Mr Barr said.

“Over the same period the share of lots sold sized below 300 sqm has increased from 6% to 10%.”

Oliver Hume has been appointed as the sales and marketing agents for a number of projects around SEQ, including the balance of Tribeca’s $25 million OTTO project at Coomera; the $135 million, 600-lot Carver’s Reach project at Park Ridge for Golden Gate Property; the Arcadia Park Ridge project for developer Goldengrove; and a soon-to-be-launched project at Ripley.

The company is also preparing to launch a major marketing campaign for Oliver Hume Property Fund’s The Verge project at Logan Reserve.

Oliver Hume Chief Operating officer Julian Coppini while the the market had remained relatively stable over the last 12 months, the company had secured a number of new local developers as clients and extended its relationship with Defence Housing Australia (DHA).

“With strong interstate migration, a stable economy and plenty of new infrastructure on the way we are quite optimistic about the South East Queensland market and that is manifesting in the number of developers pushing ahead with new projects,” Mr Coppini said.